We were able to gather valuable information that will make more people wish it was their credit card. It’s so exclusive that most information about it is undisclosed, including the required minimum income and penalty fees. There’s no doubt that the American Express Centurion Black Card is considered one of the most prestigious credit cards in Singapore. Minimum income requirement isn’t disclosed but a history of $250,000 and above in spending is required. Some owners will also receive invites to some of the most prestigious events in Singapore and overseas!įrequent rebates, flight upgrades, access to airport lounges, 24/7 concierge services, personal shopper, and personal travel agent On top of that, owners will get to enjoy at least 2 visits to more than 600 airport VIP Lounges worldwide. It’s no surprise that a lot of jetsetters we know are rushing to get hold of this prestigious credit card. Owners who book a business class flight on any airline using the OCBC Elite World Card will receive a cash rebate worth 50% of the total purchase. The OCBC Elite World Card is a credit card that allows users to enjoy endless benefits without feeling broke at the end of the day. It may have slightly lower requirements for owners than others but its privileges surely don’t disappoint. When you look at it, it’s no longer impossible for a lot of people to get their hands on one of the most prestigious credit cards in Singapore. It’s one of the few black cards in Singapore with annual fees that don’t go beyond S$2,000.Īnother noticeable feature about the OCBC Elite World Card is its relatively low income requirement of S$250,000 compared to other top-tier black cards. If you’re looking for a black credit card that can be within your reach a few years from now, then look no further than OCBC Elite World Card. Minimum income of S$250,000 and age of 21 One of the lowest annual fees for a black cardįrequent rebates, travel privileges, exclusive invites to events, preferential fees and exchange rates, and airport lounge access

Both of them are perfect for the ultrarich, but black cards really are for the richest of the rich. On top of that, the most glaring difference would have to be the requirements and each one’s target market. If you’re a person who loves to travel, you’re definitely going to enjoy the seemingly endless perks that come with black cards.

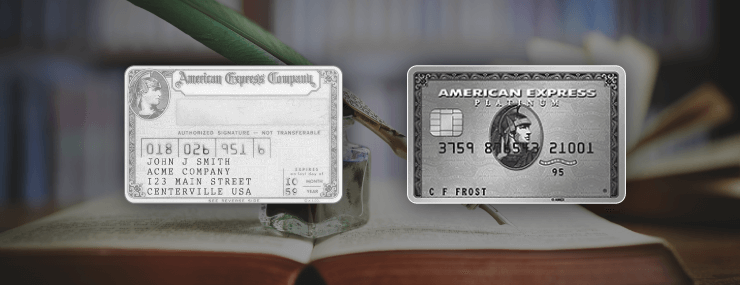

Yes, obviously, black cards offer more premium and exclusive benefits that don’t come with platinum credit cards. Is there a difference between platinum and black cards? We even heard the minimum income requirement for American Express black cards reaches astronomic heights, so we’ll leave it up to your imagination how much that is.īlack cards wouldn’t be marketed towards high-net-worth people if they didn’t require ridiculously high monthly income from members.Ĥ. The required monthly income usually ranges from S$300,000 up to S$600,000. Required minimum income varies depending on the bank and card, but it’s safe to assume that you need to have a net worth of either millions or billions to qualify for them. What’s the required income to qualify for platinum and black credit cards? There are even far more prestigious black cards with undisclosed annual fees: for most people, the fees for those will be anything but affordable.ģ. Owners can expect to pay no less than S$500 per year, but there are others with almost S$3,000 in annual fees, on top of initiation fees that cost almost S$10,000. Obviously, black credit cards have higher annual fees compared to all the other types. How much do platinum and black credit cards cost? Some of these benefits are higher credit limits, higher travel insurance coverage, special hotel upgrades, travel credits, access to airport lounges, and 24/7 concierge services, among others.Ģ. It offers more benefits and perks than the standard, gold, or even premium credit cards. How do platinum and black credit cards work?Ī black credit card is the most prestigious type of credit card that exists, reserved only for millionaires and billionaires. All of them come with ridiculously high requirements that only rich people can meet, so the chances of qualifying for them is really small.Īnyway, here are some questions that will shed some light on platinum and black credit cards in Singapore.ġ. It’s worth noting that the most prestigious credit cards in Singapore are only available through invites from various banks and financial institutions. They’re usually referred to as “black cards” or “platinum cards” and are treated as status symbols.

You might have a lot of questions about them, but one thing’s certain: only the richest people qualify for them. UOB Reserve Card Frequently Asked Questions about the Most Prestigious Credit Cards in Singapore

0 kommentar(er)

0 kommentar(er)